Eight Superannuation changes you need to know

Superannuation is currently a hot topic following recent announcements to legislate a purpose for superannuation in addition to introducing additional tax for super balances over $3 million.

Whilst these announcements still have a way to go before they turn into legislation, it is important to understand the changes that have come into effect over the last 18 months along with those scheduled to come into effect from 1 July 2023.

We explore these superannuation changes in further detail to help you be better across the opportunities they may create for you.

Changes - coming into effect on 1 July 2023

1. Increase in the Compulsory Super Guarantee Rate to 11% - effective 1 July 2023

From 1 July 2023 the super guarantee rate will increase from 10.5% to 11% for all employees.

FMA recommends you review your salary sacrifice arrangements as of 1 July 2023, to ensure you or your employees do not inadvertently breach your concessional contributions cap in the 2024 financial year.

2. Indexation of the Transfer Balance Cap - effective 1 July 2023

The $1.7m Transfer Balance Cap will be increased to $1.9m due to indexation with effect on 1 July 2023.

The transfer balance cap was last indexed from $1.6 million to $1.7 million on 1 July 2021. From this date there was no longer a single cap that applied to all individuals - this was due to differences around the value and timing of when superannuation members entered retirement phase.

The reason to transfer super from accumulation phase to retirement phase, is to obtain a tax exemption on the earnings generated. In accumulation phase investment income (income and realised capital gains) is taxed at 15% (with a one third discount on capital gains held for greater than 12 months). In contrast, in retirement phase investment earnings are tax free.

There may be advantages for those who have not previously entered retirement phase, to hold off doing so until after the indexation occurs on 1 July 2023. If you are considering entering retirement phase and drawing an income stream, it would pay to seek personalised advice due to the complexities involved.

3. Transfer Balance Cap Reporting will be a quarterly requirement - effective 1 July 2023

All SMSFs will be required to report quarterly, even if the member’s total super balance is less than $1 million. This means you must report events that affect a transfer balance within 28 days after the end of the quarter in which the event occurs. The most common events are new pensions commenced or lump sum payments taken.

This change in compliance reporting increases the need for SMSF trustees to be up to date with their paperwork and reporting. Any individuals looking to enter retirement phase and commence a pension within their SMSF should consider seeking advice from FMA on what needs to be reported.

4. Temporary reduction of Minimum Pension Drawdowns - ends on 30 June 2023

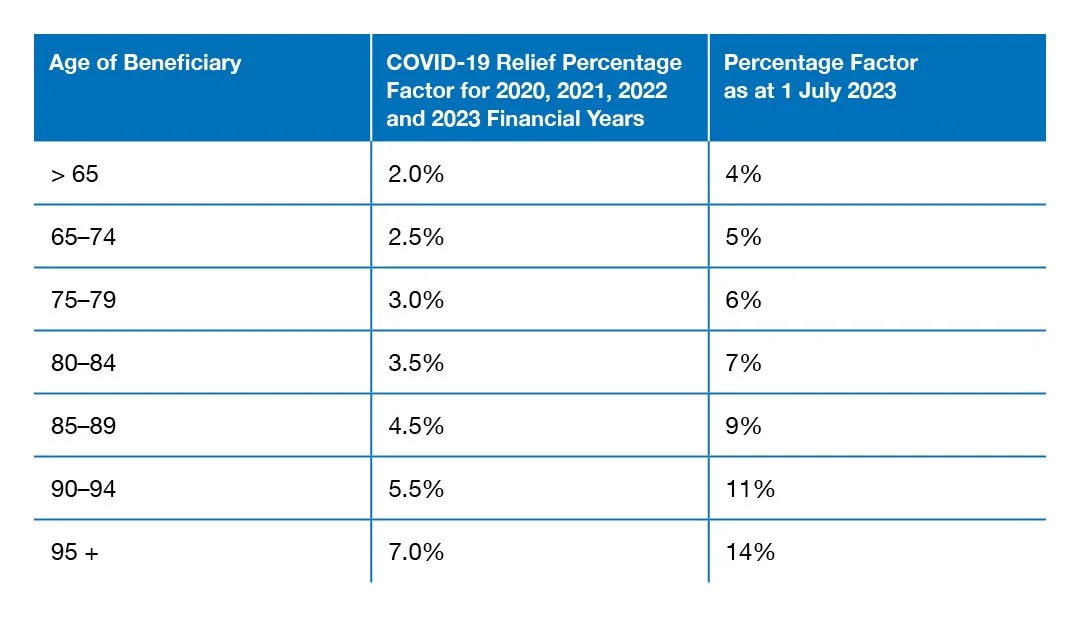

The government has not made any announcements about extending the temporary (due to COVID-19) 50% reduction of minimum drawdowns on pensions and these are scheduled to revert to previous existing rates. Please see the table below for the different percentage factors.

The liquidity of your superannuation will become more important for those in retirement phase. Failing to meet the minimum pension drawdowns will remove the tax exemptions afforded to those in retirement phase and income relating to these pension accounts will become taxable. It is therefore extremely important that any pension drawdowns are adjusted accordingly from 1 July 2023 and cash flow is monitored to ensure funds are available to meet the new drawdown requirements.

Recent changes – already in effect

5. SMSFs can now have up to six members - effective 1 July 2021

The maximum number of members for an SMSF increased from four to six.

One of the main benefits of this change is that bigger families are able to share a single fund and pool funds to allow for a broader range of investments.

6. Removal of the Work Test for those aged under 75 for Non-Concessional Contributions - effective 1 July 2022

The pre-existing work test was abolished on 1 July 2022 for those aged under 75 looking to make non concessional contributions. The work test will continue to apply for members seeking to make a personal concessional contribution.

This change has created an opportunity for individuals who are aged over 67 (but under 75), to boost their superannuation balances without undertaking paid work. Those individuals with tight liquidity in their funds may consider making additional contributions to help cover the additional pension drawdown requirements from 1 July 2023.

7. Use of the ‘Bring Forward’ Provisions for those aged under 75 - effective 1 July 2022

Following removal of the work test requirements for personal contributions by super members aged under 75, alignment with the bring forward provisions allows fund members to use the existing bring-forward rules for non-concessional contributions, to make up to three years of non-concessional contributions in a single financial year.

This change allows up to $330k to be contributed in a single financial year. As we approach the end of the 2023 financial year (and the start of the new financial year), there is an opportunity to contribute $110k this financial year and $330k on or after 1 July 2023. This will allow you to effectively contribute $440k over a relatively short period.

8. Reduction of the age threshold for downsizers - effective 1 January 2023

The age eligibility for downsizer contributions was lowered from age 60 to 55, allowing retirees to contribute up to $300k to their super following the sale of their home. Couples may be eligible to contribute up to $300k each.

The benefit of the downsizer contribution is that it does not reduce the amounts which are able to be contributed under the non-concessional contribution cap. Strict eligibility criteria applies, so it may pay to seek personalised advice from FMA before considering this option.

The Final Word from FMA

It is important to be aware that whilst legislative changes may present exciting new opportunities, SMSF trustees must consider whether their current trust deed allows the fund to take advantage of these changes. Without an up-to-date deed, the trustee may not be able to operate in the manner that it wishes, without being in breach of the rules of the Fund. FMA therefore recommends that all SMSF holders, who have not reviewed their trust deed in the last two years, consider a deed update in light of recent and upcoming superannuation changes. As always feel free to reach out to Andrew and the team at FMA, so they can assist you in better understanding how you could benefit from these changes.